Alligator Indicator Tutorial with Images

Most of the time the market does not move anywhere. Only 15-30% of the time it forms some trends, and many traders derive almost all of their profits from these trend movements. Everyone knows that the best trading system is one that avoids a double interpretation of signals, that is, the simplest one. And today we will analyze the trend indicator, which is quite capable of becoming the main element of such a vehicle – the Alligator from Bill Williams.

Introduction to Alligator Indicator

Indicator Alligator (or Alligator Bill Williams) is a trend and signals the beginning of a new trend. It includes a number of moving averages , in which fractal geometry is applied, as well as nonlinear dynamics. The indicator is quite popular and comes in packages for the analysis of most terminals. It was used by Williams in the system ” Trading chaos “, described by him in the book “New Changes in the Exchange Trade.”

Characteristics of the Alligator Indicator

Platform: Metatrader 4

Currency pairs: Any

Timeframe: from H4 and higher

Trading time: round the clock

Type of indicator: classic trend

Recommended DC: Alpari , Forex4You , RoboForex

Description of Alligator Indicator

The combination of the three moving averages is a more complex construction, “read” which is not always easy. Perhaps that’s why many quit working with the averages, hoping to get more information from all sorts of indicators, most of which are nothing but a slightly different way of displaying a sliding line.

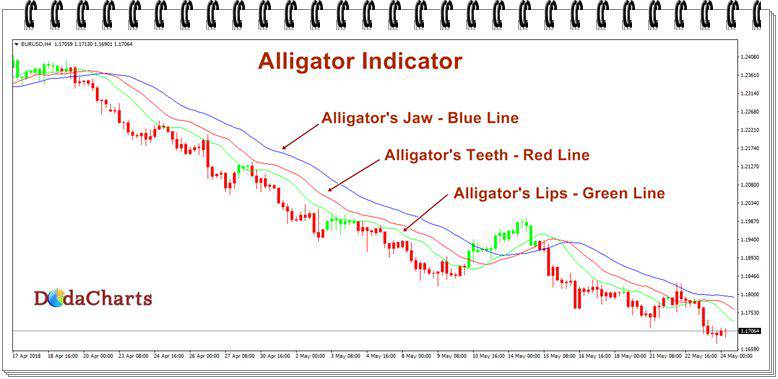

This indicator is displayed on the price chart by three moving averages that have certain periods and offsets. Trading on the indicator Alligator is best done on the daily charts and higher. Its distinctive feature is that it theoretically works on all timeframes, which makes it universal, but, as practice shows, on TF less than H4 it is better not to drop.

Forex alligator got its name due to some similarity with the crocodile. In form, it resembles an alligator that is closed, then with a slightly open, or even open jaw.

Determining the mood and intentions of the Alligator is not difficult. It’s enough just to look at the three smoothed moving averages that have just been considered by us.

-

The longest of them, which is at the same time the balance line, is the “Alligator’s Jaw”. Note this line in

blue .

-

A faster moving average (8-period, having a shift of 5 bars to the future) is the “Alligator’s Teeth,” making it

red .

-

The shortest is called “Lips of the Alligator”, and it will be designated

green .

Together these three lines perfectly show the character of the Alligator, and also determine all his actions in the present and plans for the future.

When the Alligator is satisfied, he does not care what happens in the market. He’s sleeping. At this time, moving averages show his complete indifference to the environment. All three lines are intertwined at this moment in such a way that they are often difficult to distinguish and even more so, where each of them will go when the following bars occur. In the period of “hibernation” of the Alligator the market is characterized by a state of a regza, or a lateral trend.

But some time passes, food in the stomach of the Alligator is digested, it awakens him from sleep. What do you do when you wake up? I do not think that you immediately jump up and run somewhere. The alligator starts to “yawn,” and this immediately reflects on the nature of the interlacing of the moving averages: the amplitude of the oscillations becomes wider, so the space between the lines widens slightly. At such a time, you should wait for the appearance of a fractal, indicating where the Alligator is going to crawl in search of food. As soon as the fractal appears, it’s time to prepare for trading along with the indicator. So, after Alligator picks, he wakes up and goes hunting.

The question remains – how to determine how the Alligator is hungry?

Very simple! As soon as he begins to hunt, his Mouth opens (the blue line), exposing the Teeth (red line), and leaving the Lips (the green line) closest to the price bars. In other words, all three lines diverge in the order that is customary for the trend: the line with the longest period (13 period) is the most distant from the price bars, the 8th period is located between the 13th and the 5th period, the last of them are closest to the bars. While the Alligator is hungry, his Mouth opens wider and wider, which indicates an increasing desire to eat well. This is a clear sign of the trend. On the end of the trend can be judged only when the mouth begins to close, that is, the Alligator intends to stop hunting. Sometimes this means only a temporary respite.

It should be noted that the intersection of the Alligator lines is the first signal of the beginning of the movement in one direction or another. The intersection of all three lines is another additional signal, after which the “mouth” should begin to open.

-

The blue line (Alligator Jaw) is the Balance Line for the time period, which was used to plot the graph (13-period smoothed moving average, shifted by 8 bars to the future);

-

The red line (Alligator’s teeth) is the Balance Line for a significant time period an order of magnitude lower (8-period smoothed moving average, shifted by 5 bars into the future);

-

The green line (Alligator’s Lips) is the Balance Line for a significant time period, which is lower by another order (5-period smoothed moving average, shifted 3 bars into the future).

Lips, Teeth and Jaw Alligator show the interaction of different time periods. Since trends in the market can be identified only within 15-30 percent of the time, it is necessary to follow the trends and not work in markets that change only within certain price periods.

When the Jaw, Teeth and Lips are closed or intertwined – the Alligator is going to sleep or is already asleep. When he sleeps, his hunger increases – the longer he sleeps, the more hungry he will be when he wakes up. When he wakes up, the first thing he does is open his mouth and start yawning. Then he begins to smell the food: the bull’s meat or the bear’s meat, and the hunt begins. When the Alligator thoroughly nests – he loses interest in the food-price (the Balance Lines converge) – this is the time for profit taking.

Calculation of Alligator Indicator

MEDIAN PRICE = (HIGH + LOW) / 2

ALLIGATORS JAW = SMMA (MEDIAN PRICE, 13, 8)

ALLIGATORS TEETH = SMMA (MEDIAN PRICE, 8, 5)

ALLIGATORS LIPS = SMMA (MEDIAN PRICE, 5, 3)

Where:

MEDIAN PRICE – the median price;

HIGH – the maximum price of a bar;

LOW – the minimum price of a bar;

SMMA (A, B, C) is the smoothed moving average. Parameter A – smoothed data, B – smoothing period, C – shift to the future. For example, SMMA (MEDIAN PRICE, 5, 3) means that the smoothed sliding is taken from the median price, while the smoothing period is 5 bars, and the shift is 3;

ALLIGATORS JAW – Alligator jaws (blue line);

ALLIGATORS TEETH – Alligator teeth (red line);

ALLIGATORS LIPS – Lips of the Alligator (green line).

“Jaws of the Alligator” show information about what prices will be set on the market, if new factors do not affect it. If the price is above this line, then the market will not only move up, but also positively evaluate new factors. Accordingly – if the price is below the “jaws”, then the market will move down and negatively assess the new factors.

How to use Alligator indicator?

Determination of the strength of the trend

In order to determine how strong the market will be, you need to analyze how long the moving averages are in the crossed state. The longer the indicator lines are in this position – the greater the likelihood that a strong trend movement is expected soon.

Entrance

The Alligator indicator also provides signals that indicate when to enter the position. If during the trade the moving averages begin to increase in amplitude, and the distance between them gradually grows, then it shows that a new trend starts. Its direction will show the appeared fractal, when the candle completely closes above all three moving average indicators. After this fractal appears – you should start trading. The purchase should be made only when the Alligator lines start to move up and are below the formed fractal, which will be directed upwards (a closed bulb of a candle) and be above the green line.

The signal for sale is the position of the fractal below all the lines, which will be completely directed downwards (a closed bearish candle) and be below the lips of the Alligator (green moving average).

Typically, the Alligator indicator is not used alone (like any other indicator) to enter the market. We need confirmation in the form of a fractal directed upwards, or one more signal from another indicator (for example, a stochastic ).

Stop Loss

To set a stop-loss when opening a position, it is recommended to navigate along the blue line of the indicator.

Trend filter

The signals of the Alligator indicator are also used to determine the trend. In the event that the blue moving average is farthest from the price bars, the red line between 13 and 5 moving averages, and the green line is closest to the rest of the price chart, then you can be sure that there is (or only starts) a trend. If the price is higher than 3 lines – it is upward, if on the contrary – downward.

Exiting the position

You are already probably figuring out how, using the Alligator, to choose the right time to exit the market with maximum profit. Best of all, perhaps, any system, built on the use of trailing stops, will do. For example, you can focus on the line of teeth, which is an 8-period smoothed moving average, shifted by 5 bars into the future. Another very good option – the use of the indicator Parabolic SAR, which draws points above or below the price, depending on the current trend. If you still prefer work in high periods (from H4 and higher), then you might well approach trailing by shadows of candles, extremums or fractals.

Disadvantages of Alligator Indicator

Alligator has several drawbacks, like any other indicator.

-

Firstly – any signal appears late. For its formation, a definite trend in the market is needed;

-

Secondly, Forex Alligator creates a lot of false signals in a quiet market (especially when crossing lines). For more or less accurate response to the signal, it is necessary to use additional filters (RSI, for example, which also generates signals for the movement and rollback of the currency pair).

Conclusion

Today we reviewed the application of the classic trend indicator Alligator in the trade. If you are a fan of trend trading systems, then you definitely should try to try on the Alligator to your strategy. Perhaps this is exactly what you so long did not have.