What is the Renko indicator and how to use it in trading?

renko_chart renko_indicator renko_chart_tutorial renko_for_beginners

The Renko indicator tracks the price movement of a financial asset in the form of bricks arranged diagonally. Find out what a renko chart is and how to incorporate it into your trading strategy.

What is the Renko indicator (Renko Charts)?

A Renko indicator is a type of stock chart that is constructed in the form of bricks of equal size that follow one another to draw an upward or downward trend by following the price movement of a financial instrument.

From the Japanese “ Renga ” (which means brick in English), this indicator was developed by a Japanese trader by the name of Munehisa Homma, nicknamed the “god of the markets”.

Unlike other indicators, the Renko chart uses only the price movement, while removing the time factor as well as the phases of horizontal price oscillation without direction. A Renko chart is simply a summary of Japanese candlesticks and point and figure charts.

The purpose of this indicator is to allow the trader to focus only on large and significant market movements, depicting the current price direction in a simple and clear manner.

The Renko chart only displays price movements that reach or exceed the limit previously set by the trader himself. Any price change that does not reach this minimum amount is generally filtered out.

How to understand and interpret a Renko chart?

The Renko chart is made up of a series of bricks (also called boxes or blocks) of equal size, positioned diagonally at 45 degree angles to each other (up or down), and which indicate upward (green) or downward (red) price movements.

In the case of a bullish Renko candle , the top of the rectangle symbolizes the closing price and the bottom the opening price. Conversely, the top of a bearish Renko candle symbolizes the open price and the bottom the close price. The Renko indicator is used for trading in the forex , cryptocurrencies , commodities and indices market .

The bricks of the Renko indicator have a time axis, that is, they are created over time. They can take seconds, hours, or even days to build depending on market volatility. In a context of high volatility bricks are created quickly, while in a market with low volatility it will take longer to see a renko block created.

The first step in building a Renko chart is to select a brick size that represents the magnitude of price movement. Choosing the size of a brick is important because:

The larger the brick size, the longer it may take for the indicator to form

When the size of the brick is small, this formation will be faster.

Although a fixed box size is frequently used by traders, the use of the ATR (or Average True Range) indicator, which is a measure of volatility that fluctuates over time, is also recommended.

Decreasing the size of a brick will certainly create more fluctuations, but will also highlight possible price reversals sooner. A larger brick size will reduce the number of swings and noise but will be slower to signal a price reversal.

When a strong trend is forming, Renko traders may be able to follow that trend for a long time even before a brick forms in the opposite direction. Trading signals are usually generated when the direction of the trend changes and the bricks alternate colors.

It is very easy to interpret a Renko indicator: when the bricks are placed on top of each other, it is an uptrend and when one brick is below another, then we speak of a downtrend.

How is the Renko indicator calculated?

There are different formulas to calculate the Renko indicator . Some are based on highs and lows, while others tend to consider all price behavior spanning the opening and closing price of an asset.

The dimension of a renko brick takes into account a unit of variation whose value is calculated by considering elements such as the price and the different combinations of prices.

How to determine the size of a Renko brick?

There are several formulas to calculate the size of a brick in the renko indicator:

The first formula requires taking into account a single price in which the unit of variation of the Renko can be applied to the opening price, the highest price, the lowest price or even the closing price.

The second formula consists in using a method which is based on weighted, median or typical prices. In this approach, the variation unit can be applied to different formulas such as:

(open price + close price) / 2(highest price + lowest price) / 2 (highest price + lowest price + closing price) / 3 (highest price + lowest price + 2 times closing price) / 4 (open price + high price + low price + close price) / 4

There are also trading software like MetaTrader MT4 or MT5 which offer to use an ATR (Average True Range) indicator which measures the size of the Renko bricks, gives dynamic support and more accurate resistance levels.

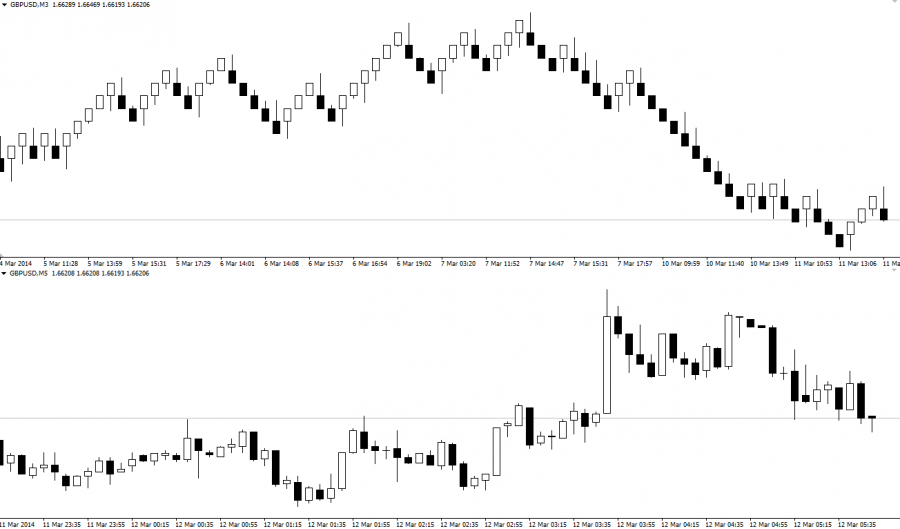

The above figure is the pictorial representation of Renko Chart and Japanese Candles.

How to trade with the Renko indicator?

The Renko indicator, which helps filter out market noise and see the trend more clearly, is often used by traders who follow trends and trend reversals.

It is ideal for certain short and long term trading styles such as scalping , swing trading or day trading . The Renko indicator is also used in different markets such as forex, indices, commodities and cryptocurrencies.

Advantages and Disadvantages of Renko Charts

Trading with the Renko indicator has advantages and some disadvantages.

The advantages of the Renko indicator

- The main advantage of a renko chart is that it shows market trends more clearly compared to traditional Japanese candlestick charts.

- A renko chart has a much “smoother” appearance than so-called classic candlesticks, which helps to identify the direction of the trend more easily.

- Another advantage of this graphical representation is that it is very effective in highlighting trends as well as support and resistance levels in the stock market.

- With renko , you can only set the colors of the candles, even if the setting of the period remains an important element that should not be neglected, depending on your investment duration.

- This indicator or graphical representation mode also brings other advantages.

- It makes it possible to identify the weakening of a dynamic.

- It helps to detect trend reversals.

- It gives signals to position yourself for buying or selling short.

- It identifies trends and helps detect their weakening, allowing you to stay in the trade without getting nervous or making unnecessary moves.

- It applies to any instrument, any time frame and on all stock markets.

- It can be used in addition to candlesticks in Japanese candlesticks.

- Finally, renko charts are also easier to read because the markers on the chart called bricks, boxes, or blocks are more uniform than Japanese candlestick charts, thus making better visibility for traders who want to use this indicator to track market movements. price.

- Indeed, technical analysis using a renko chart indicator is much simpler and particularly effective for novice traders.

- Additionally, retracements and trend continuation patterns are easier to spot and allow traders to identify and focus on the most important trends.

The disadvantages of the Renko indicator

Among the disadvantages of the Renko chart, let us mention that:

- The main disadvantage of the renko indicator is its lagging or “lagged chart” character, because by design it only looks at trends.

- Therefore , any strategy that uses renko should take into consideration that lagging indicators also provide false signals that need to be filled by using other tools from technical analysis.

- Also, the bricks created by the renko chart indicator do not give the trader the same information as a classic Japanese candlestick, namely the opening price, the highest price, the lowest price or the closing price. .

- So, although prices are present in renko charts , the individual bricks do not give much information about the behavior of market participants.

- Renko trading also has other disadvantages, such as the increased signal-to-noise ratio, or the difficulty of evaluating the size of a renko brick that is suitable for your trading style (scalping renko , day trading or swing trading ).

- Finally, even though renko trading charts are easier to read because of the uniformity of markers on the chart called bricks, boxes or blocks, this simplification does come at a cost, however, as some price information is lost.

- This indicator is rather suitable for long-term strategies, even if many traders use it for scalping.

Difference between a renko chart and a Japanese candlestick chart

The most striking difference between the renko chart and the candlestick chart is the greater ease of reading and interpreting the renko chart .

The other difference between the two types of charts is the relevance of the information.

Indeed, a renko chart does not usually give you the most recent information, because a brick only updates when a new brick is created, namely that the price has moved up or down by the unit. variation chosen.

Because of this, a Japanese candlestick chart and a renko chart that was displayed at the same time will often have different prices, because the Japanese candlestick chart always shows the last price or the last trade if you are using a stock market time flow. real, while a renko chart shows the price that created the last brick.

As renko charts are based on brick size, they also do not reflect the exact price, high or low, of a hit asset.

For example, if a new brick forms at 80.12, and the price reaches 80.51 and then reverses, the Japanese candlestick chart will show the price reaching 80.51, while the renko chart will only show the price reaching 80.12, because the price did not move high enough, ie 0.39 euros more, to create another brick.

The smaller the brick size, the faster the price information will update on the renko charts .

But a smaller brick size will also make the graph look choppier.

Difference between a renko chart and a heikin ashi chart : renko Heiken Ashi

Although heikin ashi charts are also developed in Japan and can serve the same purpose as renko charts in that both highlight a trend or trend reversal.

These two graphs differ in the size of each brick.

For example a renko chart uses a fixed value to determine the size of its bricks while heikin ashi charts take an average of the open price, the high price, the low price and the close price for the period current and previous.

Therefore, the size of each box or candle is different and reflects the average price.

What you need to know and remember about the renko indicator for trading

A renko chart helps to identify the market trend, as do the heikin ashi , Kagi line or Three line break charts.

Renko charts are made up of bricks that are created at 45 degree angles to each other.

Consecutive bricks do not lie next to each other.

A brick has a size which is defined in relation to the unit of price variation which is defined from a number of points or a certain percentage.

Renko charts are created from opening, closing, high or low prices but they can also be created from formulas based on weighted prices, median, typical, etc.

Renko charts have a time axis whose time scale is not fixed, as some bricks may take longer to form than others, depending on how long it takes the price to move the size of a box.

Renko charts filter out noise and help traders see the trend more clearly, since all moves that are smaller than the size of the box are filtered out.

Tips for trading with renko

When using the Forex renko chart with another indicator such as RSI , macd or stochastic , it is better to use a brick model that will be calculated from the ATR indicator as seen in the paragraph below above “Formula or method for calculating the renko chart ”.

Moreover, for this combination of indicator to be profitable, it is advisable to use the same periodicity, both for the ATR and for the technical analysis indicator RSI, macd , or stochastic .

For example for a renko trading strategy based on the RSI , it is sufficient to use the 20-period RSI indicator and a 20-period ATR to optimize the reading of an ATR renko brick .

What is the Renko indicator and how to use it in trading in a nutshell

The Renko indicator , which is made up of bricks whose size depends on the unit of price change, allows you to quickly identify the market trend by filtering noise or micromovements. This indicator can be used alone, or in combination with other indicators like Japanese candlesticks to confirm trends.

You can use the Renko indicator to trade indices, commodities and forex via MetaTrader 4