Parabolic SAR Technical Indicator Tutorial

The Parabolic SAR is designed for trending investors who want to know when a market's momentum might change direction. Find out how to calculate it and how to use it in your trading.

What is the Parabolic SAR indicator?

The parabolic SAR, or Parabolic Stop And Reverse, is a technical indicator used to predict the reversal or continuation of the trend of an underlying market. A reversal can be a bull market turning into a bear market , or vice versa, and continuation means that a market will continue its previous momentum. An investor can use the parabolic SAR to time their entry into a long or short position.

This indicator was first used by the investor and analyst who created the relative strength index (RSI) , J Welles Wilder Jr. He developed the parabolic SAR with three main functions: to highlight the current trend, to try to predict a trend reversal and provide potential entry and exit signals during a reversal.

Calculation of Parabolic SAR

The calculation of parabolic SAR differs depending on the existing trend.

Uptrend: PSAR = Previous PSAR = Previous AF (Previous EP - Previous PSAR)

Downtrend: PSAR = Previous PSAR = Previous AF (Previous PSAR - Previous EP)

In this formula, EP, or extreme point, is the higher high for an uptrend and the lower low for a downtrend. It is updated as soon as a new EP is reached. The AF, or acceleration factor, is a constant of 0.02 increasing in increments of 0.02 as soon as a new EP is reached, with a maximum of 0.20.

However, many trading platforms, allow you to overlay the parabolic SAR on a price chart with a single click.

How to trade using Parabolic SAR?

To trade using the Parabolic SAR, you must first understand what each signal means. The parabolic SAR produces a series of dots, called a parabolic line, below and above price movements on an asset's chart. These dots can be green or red.

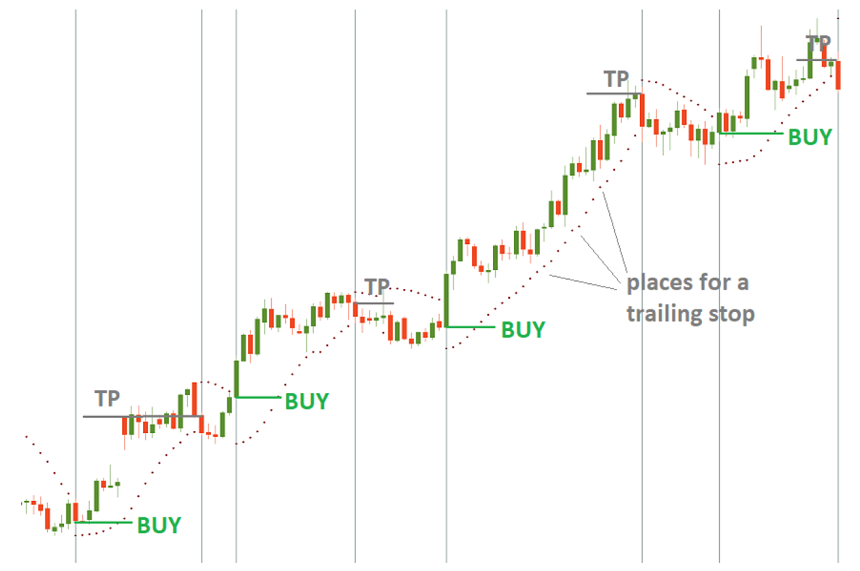

When using the Parabolic SAR to trade, you buy when the dots move below the current price of the asset and are green. Conversely, you sell if the dots are moving above the current price of the asset and they are red.

After a series of red dots, indicating a bear market, investors generally consider the first green dot to be a signal for a reversal of the current trend. This is when they usually decide to close their short position if they had one, and open a long position on the same security.

The reverse applies when a series of green dots is followed by a red dot. The series of green dots indicates a bull market. However, the first red dot usually serves as a signal to close a long position and open a short position at the same value. Indeed, the bullish trend becomes bearish.

That being said, the signals provided by the Parabolic SAR Indicator are not always completely accurate and you should perform your own fundamental and technical analysis for the stocks you wish to invest in before opening a position.

Trading strategies using parabolic SAR

The trading strategy using the parabolic SAR is generally a trend following strategy. It is used to identify a particular trend, and attempts to predict potential trend continuations and reversals.

For example, if the parabolic line is green, you would follow the uptrend and hold your long position. If the parabolic line is red, you would follow the downtrend and keep your short position.

However, if a green parabolic line is interrupted by one or two red dots, you might consider closing your long position and opening a short position. Conversely, if a red parabolic line is interrupted by one or two green dots, you might consider closing your short position and opening a long position.

You can use other technical trend indicators in addition to the parabolic SAR to confirm the existing trend or any potential reversal. One can quote for example the moving averages the relative strength index (RSI) and the index of the average directional movement (ADX).

The Parabolic SAR + ADX

The ADX (average directional index) is one of the best oscillators that qualify the direction of the trend as well as the momentum. The ADX has a centerline at 50, and a reading above that line indicates a momentary trend worth tracing. A value below 50 indicates that a trend is losing momentum and the market may begin to move sideways.

Regarding the direction of the trend, ADX has two lines: the +DI (green line) and the -DI (red line). When the green line is above the red line, it means an uptrend is in place; and when the red line is above the green line, it means a downtrend is in place.

Combined with the ADX, the Parabolic SAR is able to provide high probability trade signals in trending markets.

The Parabolic SAR + moving averages

Moving averages are probably the most popular technical indicators used by traders.

Traders combine multiple moving averages to confirm trends and spot trend reversals early enough. When prices are above a moving average, it means an uptrend is in place; lower prices indicate a downward trend.

The slope of the moving average indicates the strength of a trend. Moving average crossovers also help traders spot trend reversals in the market at an early stage.

Since Parabolic SAR is a lagging indicator, combining it with moving averages can help confirm prevailing trends and quickly spot potential reversals.

Key points of Parabolic SAR

- The Parabolic SAR is a technical indicator that investors use to try to predict whether an existing trend will continue or undergo a reversal.

- This indicator is based on parabolic lines, a series of colored dots

- A series of green dots indicates that the existing trend is bullish

- A series of red dots indicates that the existing trend is bearish

- A green parabolic line followed by one or two red dots may indicate a bearish reversal, and a red parabolic line followed by one or two green dots may indicate a bullish reversal

Advantages and Disadvantages of the Parabolic SAR indicator

The advantages of the Parabolic SAR indicator

- The use of the SAR gives interesting results in a strong trend.

- One of the advantages of the SAR is that it allows you to take advantage of large movements, especially when volatility is high.

- This indicator therefore makes it possible to take advantage of large powerful movements and to take profits as soon as a sign of reversal occurs.

The disadvantages of the Parabolic SAR indicator

- The main disadvantage of the parabolic sar is that by design it glues prices and because of this, when a corrective movement occurs, the SAR changes direction.

- This indicator allows you to take advantage of large powerful movements, on the other hand in the event of trend movements, many reversals can occur in the correction or rebound phase.

Trading Tips with Parabolic SAR

- The stronger the acceleration factor, the more sensitive the SAR is to price variations.

- If the factor is low, then the SAR will be away from the prices.