Learn Forex Trading Basics - For Beginners

Are you new to Forex trading and looking to learn online trading ?

This article is the “Real Forex Guide For Dummies”, a guide for beginner traders. You can learn line by line everything you need to know to start on Forex (FX).

But before continuing this reading, you should know that there are a lot of scams related to Forex on the Internet.

We will never promise you that you will become a millionaire in a few days, even if we wish you to, nor that we will never lose money.

On the other hand, we give you access to training so that you are able to trade with techniques and tools known and privileged in the world of Trading.

Trading Forex is neither a video game nor a casino game. You need to know the basics of trading to be able to move in the right direction and be aware of the risks associated with trading.

This guide to Forex Trading was written for beginners, with an educational and evolutionary approach. The goal is to introduce you to how to trade Forex and what are the mistakes that the beginner trader must avoid to increase his potential for success.

What is Forex: Definition

You may have ever wondered “What is Forex?” In finance, Forex is the contraction of Foreign Exchange , also known by the symbol “FX”.

Forex is the market (or FX Market) where the currency of one country is exchanged with the currency of another country.

It is also the largest financial market in the world, since its volume is more than 6,600 billion dollars per day (Source: Bank for International Settlements ).

Money is also extremely important in the real economy. Companies need the Forex market to carry out their international business operations, by paying an invoice in a currency other than their own, for example, while individuals use it to change their currency before traveling or to buy goods in another country on the Internet. If you have traveled to a country outside the euro zone, you must have exchanged euros for another currency at an exchange office. If so, then you have already participated in the variation of the price of a currency pair, without necessarily realizing it.

On the Forex market, currencies are traded over-the-counter between participants, which means that no central entity is involved. The Forex market is a decentralized market.

In Forex, the prices of currencies constantly fluctuate against each other, even at night. This constant fluctuation in currency prices has given rise to speculation and Forex trading.

It should be noted that currencies are traded in pairs.

For example, the value of the Euro (Symbol: EUR) will be expressed against another currency, such as the United States Dollar (USD). This forms the Euro Dollar pair, denoted EUR/USD.

What is Forex Trading?

Concretely, what is currency trading? Trading Forex involves speculating on the fluctuation of currency prices.

As currency prices move up and down, the Forex trader will seek to take advantage of these movements to make money by buying and selling a currency pair.

For instance :

- if the Forex trader anticipates a rise in the euro against the dollar, he will buy the EUR/USD pair.

- if the Forex trader believes that the Euro should rather fall, he sells the currency pair.

A gain is recorded when the trader has made a good prediction, while a loss is incurred if the trader is wrong.

Forex predictions for buying and selling a currency pair are made based on economic analysis and/or charts, which we will see later in this article.

Forex trading remains one of the riskiest forms of investment. Trading activity can be very lucrative, but you have to learn how to trade and control the risks.

The best way to do this is to practice on a risk-free demo account with virtual currencies under realistic market conditions while following these Forex courses.

Why Learn Forex Trading?

When a retail trader is looking to invest money, they are first and foremost looking for optimal trading conditions and recognized techniques for making money. Forex allows both to trade in excellent conditions. Its popularity has allowed many traders to exhibit their techniques.

Thus, the Forex market is:

- Ability to buy or sell currencies: Whether you think a currency will go down or up, you can invest your money either way.

- Diversify your portfolio: Admirals offers you the possibility of trading on 40 currency pairs, synonymous with many opportunities.

- Low barriers to entry into Forex trading. Unlike the stock market which requires a lot of capital, online Forex trading can be tackled with just a few tens of euros.

- Liquidity of the Forex market: Since this market handles the largest daily volume, investors can open and close a position extremely quickly.

- Hours: the Forex market is closed only from Friday evening 10 p.m. until Sunday evening 11 p.m. Yes, you read that right. The Forex is open from Sunday 11 p.m. to Friday evening 10 p.m. It is therefore a market open 24 hours a day most of the time!

- FX market volatility: currencies are very sensitive to market announcements, such as a change in monetary policy or an increase in key rates. Since the economic calendar is provided every day, the volatility in the Forex market is high. Also, this market deals with a multitude of operations every second. Thus, the volatility is all the more strong.

- The possibility of trading with a leverage effect: this tool allows you to invest part of your capital and have the other part lent to you by your broker. Be careful, leverage is a double-edged sword: increasing your profits as well as your losses.

- Whether you practice scalping, daytrading or swing trading, Forex trading is open to all trading styles. However, be sure to check if scalping is allowed by the broker.

—-

What are the Risks of Trading and Forex?

- Financial risks

- Transactional risks

- Counterparty risk

Forex trading has several advantages that we have highlighted in this article, but you must not forget that this market involves risks that can have big consequences.

Financial risk

This is surely the most dangerous risk. Forex has a bad reputation because it is a leveraged market. Leverage is a double-edged sword. It certainly increases the gains, but also the losses. Be careful. Invest funds you don't need, whether for Forex Trading or stock market investing. Under no circumstances should you invest money used to finance your daily life (bill, rent, credit, food, etc.).

Transactional risks

When the market is extremely volatile, the price at the time the order is placed and the price at the time the position is opened may be slightly different. In trading, this concept is called Slippage.

Counterparty risk

Even though the ESMA regulatory requirements that came into force on June 1, 2018 protect retail investors of CFDs, you should be careful about the signature quality of your broker. See if it is regulated to avoid scams.

To be even more comfortable in your Forex trading, remember to learn the vocabulary associated with this market.

Important Forex Trading Vocabulary

- Currency pairs: a currency expressed against another currency such as EUR/USD for the euro/US dollars. The Forex trader buys and sells currency pairs.

- Reading a currency pair: if EUR/USD quotes 1.1000, this means that 1 euro is worth 1.10 dollars.

- Base Currency: This is the currency listed to the left of the quote that the Forex trader buys and sells. It is EUR in the EUR/USD pair.

- Quotation or counterparty currency: this is the currency listed to the right of the quotation. It's USD in EUR/USD.

- PIP : this is the smallest variation in the quotation of a currency pair. When the EUR/USD pair goes from 1.1000 to 1.1001, it increases by 1 pip.

- Lot : Lot is a unit of measurement of the size of a trading transaction. In Forex, 1 lot corresponds to 100,000 units of the base currency (EUR, USD, GBP, etc.). There are mini lots (0.1 lot) and micro lots (0.01 lot), of 10,000 and 1,000 units respectively.

- Leverage : Leverage increases the trader's investment capacity. The Forex trader can thus spend a small amount of money and actually invest a lot more in financial markets, such as Forex. Leverage increases gains, but also losses.

- Margin : this is the capital required to open a transaction. It is released when the transaction is closed.

- Ask price: purchase price of a currency pair.

- Bid price: selling price of a Forex pair.

- Spread : this is the difference between the buying and selling price of a currency pair, expressed in pips. This is the cost paid for opening a Forex trade.

- Swap : also called rollover, is a cost or gain paid when a trade remains open overnight.

- Open a long position: is equivalent to being a buyer on a Forex trade, also called FX Trade.

- Opening a short position: equivalent to being a seller on a trade.

- Trade: a trade means opening a position for purchase or sale.

- Broker: also called broker, he is the intermediary who places stock market orders for his clients against remuneration. It is thanks to the broker that you can carry out an operation on the financial markets. Admirals is a broker.

—-

Forex Trading - Forex Currency Pairs

Learning to trade Forex starts with an analysis of currency pairs because these are the focus of the Forex market.

Any beginner in Forex trading should know that there are three groups of currency pairs: major pairs, minor pairs and exotic pairs. The major pairs all contain the US dollar, either as the base currency, or as the quote currency.

Major currency pairs

Major currency pairs are the Forex pairs with the largest trading volumes and they have the lowest spread. Major currency pairs all contain the US dollar.

Major currency pairs include:

- Euro - US Dollar (EURUSD)

- US Dollar - Japanese Yen (USDJPY)

- British Pound - US Dollar (GBPUSD)

- US Dollar - Swiss Franc (USDCHF)

- US Dollar - Canadian Dollar (USDCAD)

Minor Currency Pairs

Minor pairs, also called cross pairs, or crosses, are currency pairs that are less important than major currency pairs. Who says less important, says less liquid and offering a higher spread.

Here are some examples of minor currency pairs:

- Euro - British Pound (EURGBP)

- Australian Dollar - US Dollar (AUDUSD)

- US Dollar - New Zealand Dollar (NZDUSD)

- British Pound - Japanese Yen (GBPJPY)

- Australian Dollar - Canadian Dollar (AUDCAD)

- Euro - Canadian Dollar (EURCAD)

Exotic currency pairs

Exotic currency pairs essentially concentrate the currency of emerging countries. The economies of emerging countries do not experience the stability of the economies of developed countries. Thus, we will find this stability also in the currencies. The Brazilian Real will be less stable than the Euro and will therefore experience greater price fluctuations. The spread will also be larger.

Examples of exotic currency pairs:

- US Dollar - Hungarian Forint (USDHUF)

- US Dollar - Russian Ruble (USDRUB)

- British Pound - Polish Zloty (GBPPLN)

- Euro - Czech Koruna (EURCZK)

It should be noted that currency pairs are standardized in trading. For example, you can trade EUR/USD, but not USD/EUR. The order of currencies is standardized across all currency pairs.

You may notice that there are many currencies available in Forex, so knowing which are the best currency pairs to trade and fully understanding how Forex works is crucial for your trading.

How Does Forex Trading Work?

In the Forex market, financial instruments are therefore presented in the form of currency pairs. Therefore, each online trading operation involves the purchase of one currency and the sale of another currency at the same time.

By buying a currency pair, the trader buys the base currency and at the same time sells the quote currency. This is a very important mechanism to understand in Forex trading.

For instance :

- If a trader buys the EUR/USD pair, it means that he is buying the euro and selling the dollar at the same time. In this case, the Forex trader anticipates a rise in the price of the euro against the dollar.

- If a trader closes a buy position, the trader will buy the dollar and sell the euro. The trader is simply trading in an attempt to gain on the mismatch in currency value. At no time does he hold any currency.

In practice, this is all done with one click on the online trading platform.

Conversely :

- Selling EUR/USD means selling Euro and buying Dollar.

Note that it is not necessary to hold a certain currency to buy or sell it. With an online euro trading account, for example, you can buy and sell any currency pair. Again, everything happens automatically.

Correlations between Currencies and Sentiment of Risk

In the financial markets, there are certain correlations which are interesting to know when trading Forex, in particular those which link currencies to the feeling of risk.

You may already know that when the markets are fearful (risk aversion) because of bad news, for example, traders sell risky assets such as stocks , and buy so-called safe haven assets such as gold, and the reverse in times of euphoria (risk appetite).

Know that the same mechanism exists on the Forex market for example:

- In times of risk appetite, traders tend to buy AUD, NZD and CAD, and sell JPY and CHF.

- In times of risk aversion, traders tend to buy JPY and CHF, and sell AUD, NZD and CAD.

Thus, the Forex trader can seek to take advantage of the phases of risk appetite and aversion, by buying and selling the currencies correlated to the risk.

With experience, you can then build more advanced risk sentiment trading strategies with cross-currency analysis like this:

- In times of risk appetite, this strategy involves buying rising currencies and simultaneously selling falling currencies to take advantage of a stronger movement in the currency pair in one direction. Buy: AUD/JPY, AUD/CHF, NZD/JPY, NZD/CHF, CAD/JPY, CAD/CHF.

- In times of risk aversion, do the reverse operations. Sell: AUD/JPY, AUD/CHF, NZD/JPY, NZD/CHF, CAD/JPY, CAD/CHF.

By the same token, the CHF/JPY currency pair, with two currencies reacting similarly to risk, should not offer large moves should risk sentiment change in the markets, with the two forces neutralizing each other. .

The goal here is to do a cross-analysis on two currencies simultaneously, one that should go up, and the other that should go down, offering a potential larger movement on the currency pair that combines these two currencies, since the two forces push the pair in the same direction.

Important: each trader must make his decisions based on his personal analysis.

Correlations between Currencies and Commodities

Another form of Forex correlation to be aware of is that which links certain currencies to commodities.

These currencies are AUD, NZD and CAD. Indeed, the economies of Australia, New Zealand and Canada being highly dependent on commodity exports, their currencies are sensitive to their price variations.

Particularly,

- AUD will be more sensitive to metal prices as Australia is one of the world's largest exporters of iron and coal.

- NZD will be more sensitive to agricultural prices, especially milk prices.

- CAD will be more influenced by oil prices, since Canada's exports are overwhelmingly oil exports.

How to Trade Forex? The three stages

- Open an account with a Broker

- Choosing a Forex Pair

- Buy or sell a currency pair

Now that you know how the Forex market works while knowing the technical terms of online trading, we will be able to explain to you how you can start your trading.

Open an account with a Broker

To carry out trading operations on Forex, or any other financial market, the particular Forex trader needs to call on a broker, also called Broker.

To start Forex trading, the trader must open a trading account with an online broker.

Choosing a Forex Pair

This broker, or broker, will provide you with a trading platform that has all the elements you will need to trade.

- Quotations (prices) of currency pairs

- Currency pair charts

- Graphical analysis tools

- The interface for placing market orders

For beginners who don't want to start by opening a real account (and we strongly advise you to do so), we suggest opening a demo account.

Thus, you will be able to trade Forex in real conditions, but with fictitious money. Perfect for learning without the risk of losing your money.

Understanding the Different Types of Forex Trading Orders

The Forex trader can use different types of orders to trade currencies:

- Market order: allows you to buy or sell a currency pair at the current market price

- Pending order Buy Limit: automatically buys a currency pair at a price lower than the current price if it is reached

- Pending order Buy Stop: automatically buys a currency pair at a price higher than the current price if it is reached

- Pending order Sell Limit: automatically sell a currency pair at a price higher than the current price if it is reached

- Pending order Sell Stop: allows you to automatically sell a currency pair at a price lower than the current price if it is reached

There are also two important tools to integrate into the order for the Forex trader:

- Stop Loss (SL): allows you to automatically close a losing position at a specific level. The trader can define his maximum loss in advance before entering the position with the stop-loss.

- Take Profit (TP): allows you to close a winning position and automatically take profits at a specific price if it is reached.

We strongly advise you to trade using a Stop Loss and a Take Profit for each trade.

Gains and Losses in the Forex Market

Currency prices fluctuate constantly, and the trader positions himself by buying or selling a Forex pair.

- For example, by buying the EUR/USD pair at 1.1000, and it climbs to 1.1050, the trader takes 50 pips (minus the spread). The cash consideration will depend on the number of lots purchased.

- Conversely, if with the same trade EUR/USD falls to 1.0950, the Forex trader loses 50 pips (plus the spread).

The same logic is repeated for the sale of a currency pair.

The Mini Terminal of the MetaTrader 5 Supreme Edition trading software calculates for you the pip value and the margin before opening a position.

The Best Times to Trade Forex

The FX market is open all day and night on weekdays, but trading conditions are not the same at all hours.

Indeed, the trading conditions change while the open world markets (Ex: Sydney, Tokyo, London, New York) follow one another and sometimes overlap.

Thus, the trader will be more interested in the currencies of the open markets at this time:

- If you trade in the morning, when the European stock market opens, it will be more interesting to trade the currency pairs which include the EUR, the GBP and the CHF;

- While in the afternoon and evening, when the US markets open, it will be USD and CAD;

- Finally, at night, the trader will be interested in Asian currencies, including the JPY, AUD and NZD.

This is also due to the fact that the currencies will react to the economic announcements of their respective countries, during the opening hours of the markets concerned.

More generally, trading conditions are less favorable as soon as liquidity is lower, typically at the opening of the markets on Sunday evening and a few hours before the closing on Friday evening. This leads in particular to an increase in spreads.

The optimal trading hours are 9am to 6pm, particularly 3:30pm to 6pm, when the London and New York markets are simultaneously open.

Define your trading style

Depending on your level of risk aversion and the availability you have to trade, the Forex trader can choose one of the following three Forex trading techniques:

- Scalping Forex: Scalping Forex with multiple positions per day (highest risk).

- Trader in Day Trading Forex with a few positions per day (moderate risk).

- Currency trading on a few positions per week with Forex Swing Trading (lowest risk).

Scalping

Forex scalping is limited to one day. All your positions must be closed at the end of the day. It's a very dynamic trading style. Forex scalping is done on very short time units such as 5 minutes or 1 minute to have many trading opportunities! For example, the scalper will take 120 positions per day with a target of 5 pips per trade.

Please note: we do not recommend that you start trading with scalping.

DayTrading

Day trading Forex is also limited to the day. All of your positions must be closed at the end of your trading day. This style of trading allows you to take positions on 15-minute or 30-minute time frames. Thus, you will take less position than in scalping and your objectives per trade will be less important. For example, a day trader will take 3 positions per day with targets between 15 and 50 pips.

Day Trading is suitable for Forex traders who want to limit the number of positions and risk exposure.

These approaches obviously require taking into account the daily economic calendar, but the importance of fundamental analysis will be less important than in swing trading, since the position will be closed quickly, especially in the case of scalping.

Forex Swing Trading

If you have a full-time job, swing trading is the best alternative. You will only need to analyze the charts for a few minutes a week.

To do swing trading on currencies, the trader will focus on the daily charts and H4, or even H1 to refine the position. In this approach, news will play an important role since the position will remain open for a long time and will be subject to the influence of different factors.

Forex Tools for Beginners

When you want to trade seriously, it is important to surround yourself with the best tools.

Some tools are offered by the broker, others are to be considered by the trader himself.

- Money Management

- Trading Diary

- Fundamental Analysis

- Technical analysis

Let's start by studying trading thanks to Money Management.

Learn Trading for free with Money Management

Money management , or money management, is a set of trading rules that the trader must follow.

This time, it is not a rule for setting up a trading strategy, but capital management rules.

These rules are intended to prevent a bad trade from quickly decimating the trader's capital.

Indeed, margin trading and leverage increase the potential for gains, but also the risk of loss of the capital invested. It is therefore necessary to establish rules to protect its capital.

With losses, the trader's level of anxiety increases, and against all common sense, he increases the size of positions in the hope of quickly regaining the lost money. But more often than not, the beginner trader loses more of his capital.

Learning money management allows the trader to avoid losing too much money in case of bad days.

For example, the trader will refrain from risking more than 2% of his capital per position, so it will take a very long series of losses, less likely, to lose all his money.

He may also refrain from risking more than 5% of the capital on several positions opened simultaneously. To open a new position, he must first reduce the risk on the other positions.

In his money management, the trader can note that he will stop trading for the day if he has lost more than 5% of his capital on the same day. This can also result in limits on the number of losing positions. Stop trading for the day after two or three consecutive losses.

Establish a Trading Journal

We learn from our mistakes and this can be deeply implemented in currency trading.

Keep a log of your successes and failures, and write down all the information about this position: the instrument, the entry and exit levels, the time, the reason for entering and exiting the position.

Reading your trading journal later will help you identify the reasons for your failures and correct them, while emphasizing your strengths.

Fundamental Analysis

Forex fundamental analysis is an analysis of the state of health of the economy of a country or a monetary zone.

The analyst will focus on a country's economic data, such as GDP growth (Gross Domestic Product), inflation, employment, but also the monetary policy of central banks, as well as geopolitics, politics, disasters and anything that might affect the economy.

Fundamental traders follow economic calendar releases closely, and position themselves in the market based on whether the announcements are better or worse than the analyst consensus estimates.

Technical analysis

Conversely, technical analysis focuses on prices and charts.

The technical Forex trader studies currency charts and identifies chart patterns and price levels to which the currency pair might react, either by accentuating its previous movement, or by reversing it.

Technicians, as opposed to fundamentalists, are not concerned with the economic value of a currency economic events that might alter that value.

It should be noted that the technical analysis is divided into two sections:

- The analysis of technical indicators, which are mathematically calculated statistics.

- Chart analysis , or charting, which is based on price behavior and chart patterns.

To understand technical analysis, it is important to understand how to read charts and to be able to recognize patterns on those charts.

Forex Analysis for Beginner Trader

The most common approach retail traders should adopt is a hybrid approach to analyzing the markets and making trading decisions.

The trader can follow Forex charts and perform technical analysis, while keeping an eye on the economic calendar and news.

Indeed, when data or news is published, it influences prices and can defeat technical analyses.

A combination of the two approaches allows the trader to identify:

- Currency price trend,

- Position entry points

- Position exit points

- Risks of high volatility around major economic releases and announcements.

For example, when NFP (Non-Farm Employment) data on US employment is announced, the Dollar tends to react strongly on Forex, increasing the risk of loss for the novice trader.

Finally, it should be noted that generally, the longer the trading horizon, the more important fundamental analysis becomes, since there will be more chances that the news will impact prices.

Strategies to start Forex trading

Now that you know what Forex is in the world of trading, that you are more comfortable with the different financial technical terms and that you know the different trading styles, it is now important that you know the strategies of base.

Warning: no strategy is 100% winning.

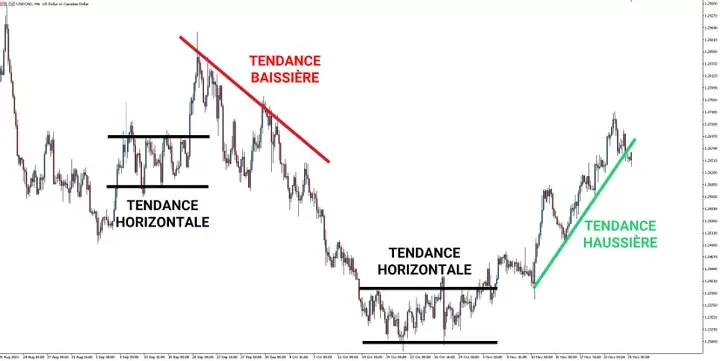

Trend Lines

Before taking a trade, you will need to know if a currency is trending up or down.

- If the trend is bullish, then the price of the currency should continue to rise.

- If the trend is bearish, the price of the currency should continue to fall.

How to draw a trend line?

To identify financial market trends on a chart, the most logical thing to do is to use trend lines, a very simple but valuable tool for drawing conclusions.

How to correctly draw a Forex market trend line?

We must first determine, at first glance, if we are facing an upward or downward trend.

- If the trend is bullish, we will find at least two consecutive rising lows.

- If the trend is bearish, it will be necessary to find two consecutive bearish tops.

- To confirm both trends, there is ideally a third top or a third bottom.

Trend lines should be drawn by joining the highs and lows as in the chart below:

Once drawn, you can then trigger your position when the price of the currency pair touches that trendline again.

When the price touches this trend line, then you can trigger your position.

How to detect a change in trend?

Once we have marked the trend, the line will help us determine if there will be a change in direction ahead: as long as the line is not broken and the lows remain above or in contact with it , it is common for it to continue. If the price breaks the line, it can be interpreted as a change signal, as if it were resistance or support.

The MetaTrader 5 has many trend indicators that help us identify them and find entry signals. Here are some of them:

- Ichimoku

- Aroon

- Bollinger Bands

- Fractal

- Parabolic SAR

- Supertrend

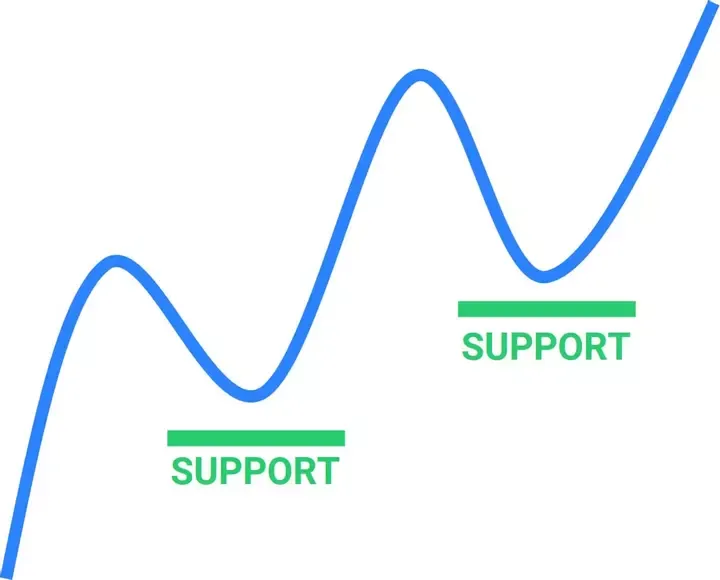

Supports and resistances

Market participants set support and resistance levels, which basically represent supply and demand.

This is where buyers and sellers clash.

Support and resistance lines are horizontal.

Forex support

The support is a line that will form a virtual barrier below which the price will have difficulty crossing from below.

Thus, when the price touches this support line, you can possibly take a long position.

Be careful, the price can also break this support line and continue to fall.

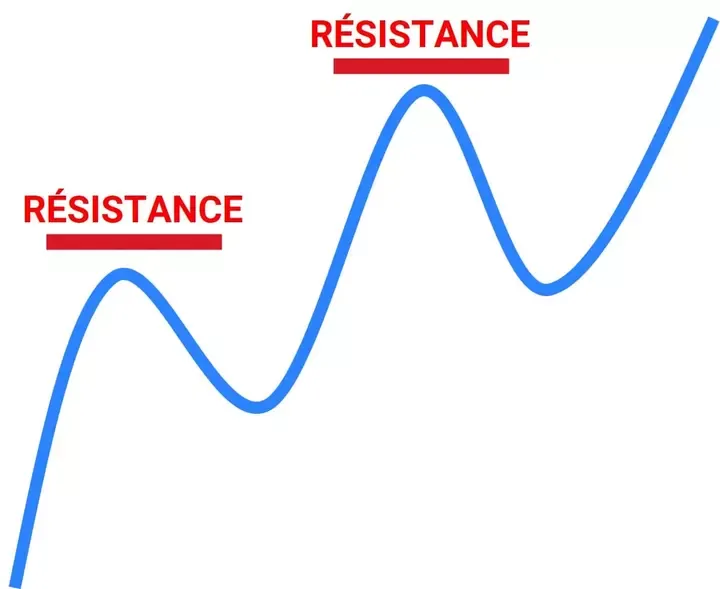

Forex Resistance

It is the opposite of support.

Thus, the resistance is a line that will form a virtual barrier that the price will have difficulty crossing from above.

When the price touches this resistance line, you will eventually be able to take a sell position (short position).

Be careful, as with the support line, the price can break this resistance line and continue to rise.

Trading the Currency Market in Range

The Forex market does not always move up or down, but sometimes moves without a horizontal trend between two levels, called ranges.

The trader can seek to sell the upper limit of the range and to buy the lower limit of the range, awaiting an exit from the Forex range.

The breakout of the range often, but not always, signals a return of a trend, either an upward or downward directional move, depending on the direction of the technical breakout.

In this example, the EUR/USD pair breaks out of the range from above, and the Euro Dollar accelerates higher. The trader who would have bought following the exit of the range would have recorded a substantial gain.

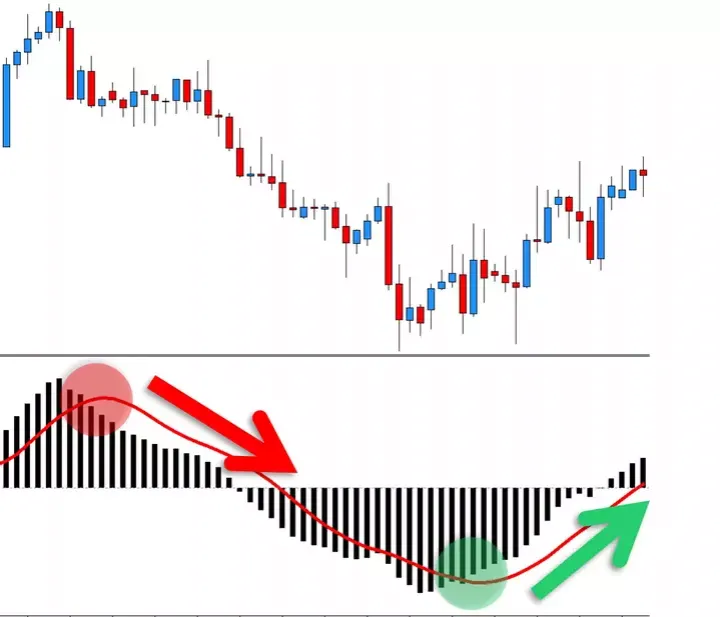

MACD

The MACD (Moving Averages Convergence-Divergence) is an oscillator with two curves. This oscillator is below the chart.

This instrument will let you know when the market is selling or buying.

The two lines, called the MACD line and the signal line, are used to spot signals to buy and sell the currency pair.

When the MACD line crosses the signal line, the signal is for buy.

On the contrary, when the MACD line crosses below the signal line, the signal is for sale.

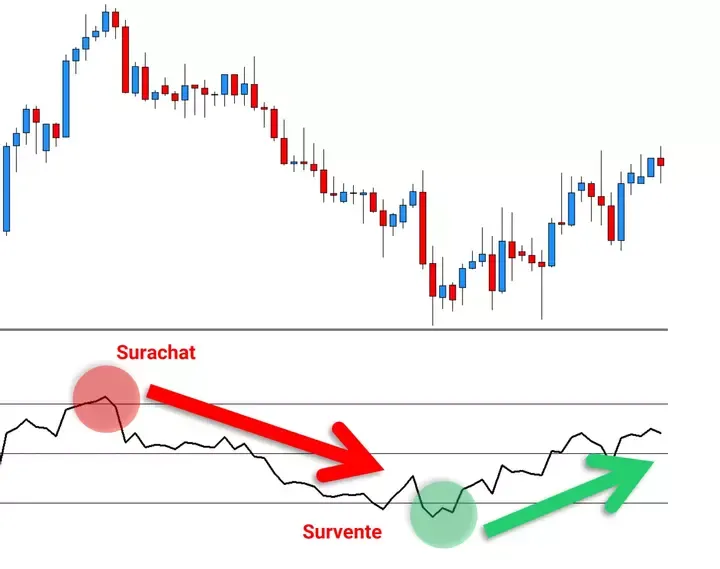

RSI

The RSI (Relative Strength Index) consists of a curve and two limits, between 0 and 100%. When the RSI value is between 0 and 30% the currency pair is oversold, when the RSI value is between 30% and 70% the currency pair is neutral and when the RSI is between 70% and 100% the pair currency is overbought.

Moving averages

As the name suggests, moving averages are averages made over different time periods. A 70-day moving average means that it will represent the average price over the last 70 days, updated daily.

There are a lot of possibilities for using moving averages, but a known technique is to trade with two moving averages, the first over a large period and the second over a small period. The first will represent a bottom trend and the second a shorter trend. The crossing will then be a sign of a change in trend or even a point of entry into the market.

Example :

- If the 50 exponential moving average crosses above the 200 exponential moving average, the market will be in an uptrend.

- If the 50 exponential moving average crosses below the 200 exponential moving average, the market will be in a downtrend.

As you can see, trading is anything but chance and a casino game.

On the other hand, we know that all this information can be complicated to understand even if we explain it in the simplest way possible.

This is why we suggest that you put this training into practice, because practice is undoubtedly the best school for progress.

We also advise you to put your training into practice by using a demo account. Thus, you are trading with fictitious money and not your real money. A loss will therefore have no impact on your capital. On the other hand, we invite you to take your trades as if you were in real conditions and note your trades in your journal.

It is only once Forex trading is properly understood that the trader can start investing his money in the stock market.

Conclusion: our 7 rules to remember to start trading Forex

This comprehensive article helps you understand the Forex market and take your first steps as a beginner trader. We recommend that you read it again and take note of our various tips.

It is possible to make profit by trading Forex, but to maximize your trading potential, we advise you to remember these 7 additional rules that you can write on a paper and put it near your trading station (computer):

- Invest only the money you can risk losing,

- Control your emotions in the face of losses and in the face of gains,

- Analyze the psychology of the trader ,

- Be disciplined by using Stop Loss and Take Profit,

- Be careful in using leverage,

- Train yourself constantly,

- Keep a Trading Journal.

FAQs

Is trading legal?

Trading is a legal activity. But you need to be careful of scams coming from the internet. To avoid scams, trade with a regulated, known and recognized broker.

What is a trader?

A trader is an individual carrying out operations on the financial markets for his own account or for a company.

What is the salary of a trader?

For a professional trader working in a financial company, his salary is approximately €70,000/year gross, excluding bonuses (source: cidj.com ).

For a particular trader, the salary will depend on his starting capital, the risk taken and the success of his strategies and objectives.

How to become a trader?

It all depends on your wish: to trade on an occasional basis or to trade on a professional basis. We invite you to read our article to become a trader .